Mexico is unusual in the importance of corn in its national diet, although consumption has fallen off, while the amount of wheat eaten has been held back by anti-obesity campaigns. The country is a major customer for grain exported from its northern neighbor, the United States. It therefore is a big importer of genetically modified grains and oilseeds, despite producing none itself. Government policy on the farm sector is shifting to focus on supporting smaller producers.

In its Grain Market Report for May, the International Grains Council (IGC) forecasts Mexico’s total grains production in 2020-21 at 36.4 million tonnes, compared with its forecast a month earlier of 35.6 million. The total crop in 2019-20 is estimated at 33.8 million tonnes.

The IGC’s forecast for Mexico’s total wheat production is 2.8 million tonnes in 2020-21, unchanged from its figure of a month earlier and up from 3.3 million the year before.

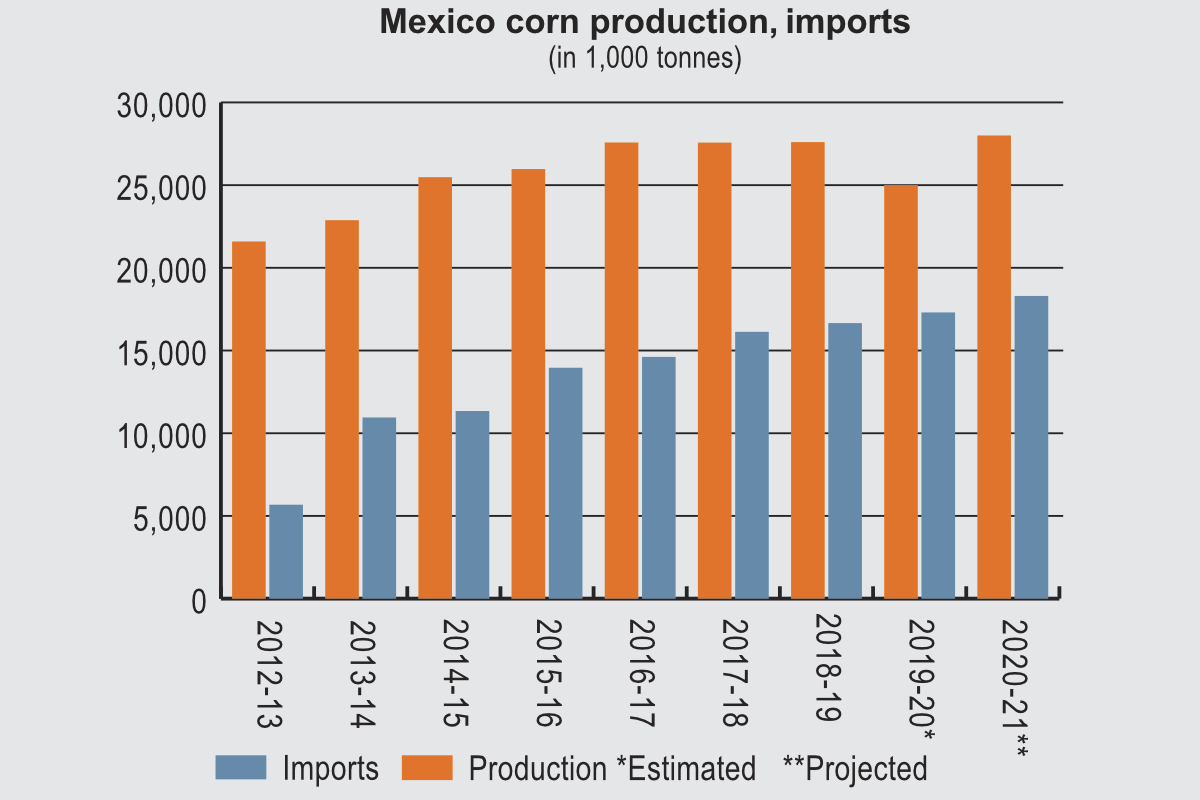

Mexico’s 2020-21 corn crop is now forecast at 27.7 million tonnes, compared with the previous month’s prediction of 26.8 million and 2019-20’s crop of 25 million.

The IGC’s estimate for the country’s sorghum production is unchanged from last month at 4.8 million tonnes, with 2019-20 at 4.3 million.

Mexico’s total imports of grain in 2020-21 are put at 25.1 million tonnes, down from the earlier estimate of 25.7 million. The country imported 23.9 million tonnes in 2019-20. The imports will include 5.4 million tonnes of wheat, an unchanged forecast, against 5.2 million the year before. Corn imports are forecast at 18.8 million tonnes, a forecast revised down from the previous month’s 19.2 million, but well above the 17.3 million tonnes imported in 2019-20.

The IGC also forecasts imports of some 600,000 tonnes of sorghum, down from 850,000 tonnes previously estimated, and down from 1 million tonnes the year before. Imports of oats are put at 100,000 tonnes, an unchanged forecast, with the previous year’s level at 150,000 tonnes.

Mexico is also forecast to import 800,000 tonnes of rice in 2020-21, a figure that is unchanged from the earlier estimate and unchanged from 2019-20.

The IGC forecasts Mexico’s imports of soybeans in 2020-21 at 6.2 million tonnes, unchanged from its previous figure and up from 6 million the year before. Imports of rapeseed in 2020-21 are forecast at 900,000 tonnes, an unchanged estimate that compares with 1 million the year before.

“Mexico will continue to be a major importer of basic grains,” the attaché said in an annual report on the sector dated March 12. “In MY 2019-20, imports are expected to continue their modest growth to meet growing demand for livestock feed. The United States is expected to remain Mexico’s principal supplier due to logistical advantages and existing business relationships.”

Wheat and milling

The attaché explained that “wheat production in Mexico continues to be spread throughout the country, with the largest producing states being Sonora, Baja California and Guanajuato, which together account for approximately 76% of total wheat production.”

In 2019-20, there was a move in plantings away from the durum-type wheat called “cristalino” to bread wheat in the states of Sonora and Baja California, the attaché explained.

The attaché put the number of flour mills in the country at 86. The most recent statistical report available on the website of the industry organization CANIMOLT (La Cámara Nacional de la Industria Molinera de Trigo) gives a 2016 total of 84 plants, with an installed capacity of 8.8 million tonnes. Capacity utilization was 74%.

Wheat consumption for food, seed and industrial use is forecast by the attaché to rise by around 1.4% in 2020-21, mainly driven by population growth. There was also an increase in 2019-20, the attaché explained, as bread consumption recovered from a reduction the year before because of campaigns to persuade consumers to eat fewer calories.

“Continued declines are also possible, as the government and public health organizations launch new campaigns to fight obesity and diabetes,” the attaché said. “At the same time, new labeling regulations that could be in place by the end of 2020 could also discourage the consumption of pre-packaged bread products.”

The new labeling regulation includes “Front of Pack Warning Signs” (i.e. black labels on foods and beverages warning that products contain “too much sugar,” “too much fat,” or “too many calories”), the report explained. Feed consumption of wheat is expected to fall because of its higher cost relative to alternatives such as corn.

“New products perceived as being healthier than traditional alternatives continue to make headway in Mexico,” the attaché said. “For example, consumption of whole grain and organic baked goods continues to rise.”

The report cites CANIMOLT as saying that Mexicans consume an average of 53.9 kilograms of wheat each a year.

Corn is king

The biggest crop in Mexico is corn, in terms of both consumption and production.

“Production in Mexico is diverse, from large-scale and irrigated commercial operations to very small farms that grow local varieties on rain-fed plots for subsistence,” the attaché said.

Corn is primarily considered as a food grain, but consumption per person has fallen in recent years.

“This contraction is explained by slowed economic growth and relative deterioration of Mexican consumer income, an increase in corn flour and tortilla prices, as well as a change in consumption patterns in the last decades,” the attaché said, noting also the effect of the increasing popularity of fast food.

The report explained that the government of President Andrés Manuel López Obrador, who came into office on Dec. 1, 2018, is changing the agricultural support system with a stronger focus on supporting small farmers, triggering protests from larger commercial operators.

In an April 17 report on the oilseeds sector, the attaché said that “the cancellation of federal commercialization support programs for medium and large oilseed growers has generated uncertainty regarding the planting intentions for the upcoming year,” and forecast unchanged soybean output, with expected rapeseed and sunflower seed crops saying “unchanged at the very low levels of the last years, due to the lack of government supports.”

The report predicted a 1% increase in oilseed crushing in 2020-21, because of demand for meal from livestock producers and population growth causing an increase in demand for oil.

A separate report on biotechnology, dated March 12, explained that the only genetically modified crop grown in Mexico is cotton.

“However, a reduced number of permits granted for GE cotton planting in 2019 created a shortage in seed availability,” the report said. “For the 2020 planting cycle, all new applications for cotton cultivation permits have been rejected or delayed.”

Long legal battles and a lack of public acceptance have suspended cultivation of (GM) corn and soy, the report said.

However, although it recognized that NGOs are active opponents of biotechnology, the report said that “in general, Mexican consumers, producers, importers and retailers remain disengaged from the biotechnology debate, with the latter often opting to let industry trade associations conduct significant lobbying and educational outreach.”

“There is more concern about the price and quality of food rather than its genetic composition,” the report noted. “However, consumers across the socio-economic spectrum generally draw a distinction between conventional and genetically engineered corn, as many have concerns about the integrity of Mexico’s native corn species. In Mexico, corn is a symbol of heritage, so acceptance of this technology may well be tied to the perception of protection of this native plant. This debate has been amplified by NGOs and government officials opposed to the adoption of this technology.”

Chris Lyddon is World Grain’s European correspondent. He may be contacted at: chris.lyddon@ntlworld.com.