For those in the business of shipping and grain, 2020 was a rollercoaster ride. Second-quarter lockdowns prompted demand for some grain-based products to spike as consumers stockpiled and splurged on specific goods, including specialty flours. However, overall global economic demand for most commodities fell precipitously, and bulk carrier shipping spot and time charter rates slumped accordingly.

In the second half of the year demand returned, prompting a summer upsurge in shipping costs. For capesize vessels, this largely tailed off in the fourth quarter, but strong agricultural volumes helped support prices for vessels in the panamax class and smaller — the workhorses of the grain and soybean trades.

“Support for the mid-sized ships in the last months of the year came from US exports of soybeans, which have been record-breaking in the first months of the export season,” noted shipping association Bimco in its November report. “Outstanding sales for this season are also high — 30.1 million tonnes — and records could be broken.”

Indeed, soybean exports from the Americas to China gifted ship owners welcome support throughout the latter part of 2020, while grain exports from the Black Sea and other Northern Hemisphere origins have provided additional ballast.

“With strong soybean exports from both Brazil and the US, China has imported a total of 83.2 million tonnes of soybeans, which is 168 more panamax loads — approximately 75,000 tonnes per load — more than in the first 10 months of last year,” noted Bimco in November. “Given the long sailing distances between Brazil and the US to China, the increase in ton-mile demand is considerable.

“Other grain exporters in the Northern Hemisphere have also provided extra demand for these ships. In the year to date, there has been a 25.4% increase in ton-mile exports on panamax and supramax ships out of the Black Sea, with Russia and Ukraine the big drivers.”

Freight rate volatility

All of which has been reflected in lurches in freight rates across the various bulk carrier classes this year.

The Baltic Exchange Dry Index (BDI) has been particularly volatile this year. The BDI sat at 1230 points on Nov. 27, down from over 2000 points in October but far above the depths of 393 recorded in May when bulk carrier demand, especially for capesize carriers, collapsed as the coronavirus pandemic strangulated global economic output.

The Baltic Exchange Handysize Index (BHSI), meanwhile, was stuck below 500 points from Jan. 1 through Aug. 17. It then rose to a peak of 649 on Nov. 27, the last reading taken before World Grain went to press.

The Baltic Exchange Panamax Index reached 1429 points on Nov. 27, down from a 2020 peak of 1824 recorded Aug. 14 but far above the 500- to 900-point range ship owners endured in both January-February and May-June.

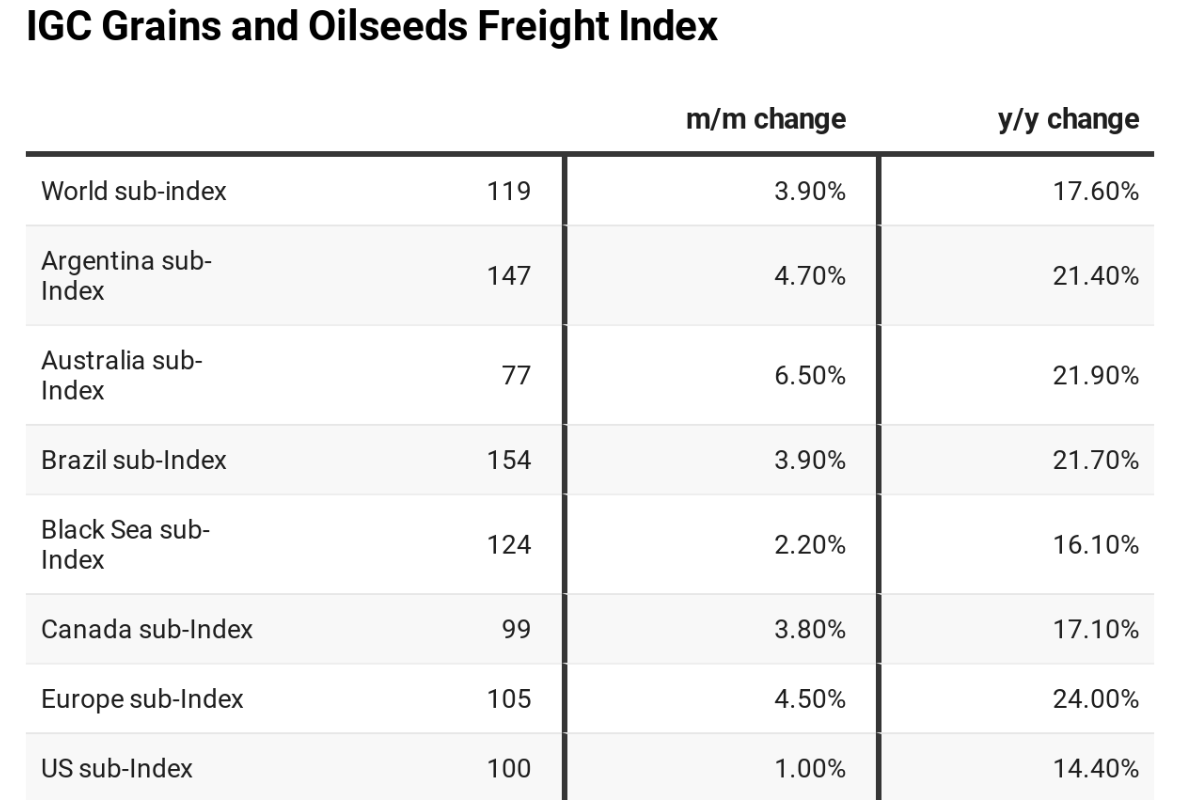

In terms of grain shipping costs specifically, the IGC Grains and Oilseeds Freight Index (GOFI, see page 54) reached 117 on Nov. 24, up some 17 points compared to a year earlier and far higher than the 72 points recorded in May at the height of global lockdowns.

COVID-19 turbulence

COVID-19 trading restrictions had a limited impact on global grain flows in 2020 with the exception of some port and border delays, Alexander Karavaytsev, international grain economist, told World Grain.

He said grain ports had generally been “operating normally during the pandemic, with grains/oilseeds shipments excluded from COVID-19 movement restrictions in many countries,” although broad-based quarantine measures had slowed handling speeds.

“There were also some initial disruptions to inland supply chains, for example in Argentina, when transport restrictions were introduced at the beginning of the crisis, but those issues were resolved quite quickly,” he added.

Karavaytsev said the effectiveness of agricultural supply chains even in the midst of a pandemic was evident in rising exports of soybeans from the United States and Brazil to China. Indeed, such has been the nature of “surging demand” that prices have soared, and logistics infrastructure is now under pressure in some port hinterlands.

“Large shipments of soybeans and maize, including to China, have resulted in especially tight loading capacity at US ports in recent months,” he said, adding that in Brazil the “record pace of soybean dispatches, mostly to China, contributed to a slow start to the safrinha maize export season during summer.”

The view for 2021

Expectations are that 2021 is certain to bring more volatility for grain shippers. Analysts expect an improving global economy, COVID-19 vaccines, Chinese trade policy and a new US president in the White House to all impact the dry bulk trades and US grain and soybean exports in some way during the next year.

“The remainder of this season looks promising given the high outstanding sales, around 29 million tonnes, left in the US,” Peter Sand, chief shipping analyst at Bimco, told World Grain. “But looking further ahead than that, the question will very much depend on Chinese policy, much more so than what the new administration sets into motion.

“The Biden administration is unlikely to be much more China-friendly than the Trump one, though the way of going about things may change.”

US-China trade relations

Under the phase one US-China trade agreement, China committed to purchasing an additional $200 billion of American-made goods and services over 2020 and 2021. However, despite the recent surge in soybean purchases, China has so far fallen short of its commitments. Could a new US administration encourage China to stock up on US exports in 2021 to meet its commitments?

Sand is doubtful.

“As the commitments set out in the agreement are far from being met this year, and with the new administration coming in next year, it raises questions as to how much support the agreement will be to US exports in 2021,” he said. “Also, given the lower pig herd in China following the massive culling of pigs in response to the African swine fever, the high growth rate this year of soybean imports suggests that they are building stocks, which paints a worrying picture for next year, if they choose to draw on these stocks rather than import more.”

MSI, however, expects the Biden presidency to be positive for trade on the basis that Biden “favors a less protectionist trade agenda than the previous administration,” although the analyst concedes that radical change is unlikely in the short term.

“First, Biden’s near-term priorities are focused inwards, toward building a post-COVID lockdown recovery for the domestic economy,” MSI said. “Second, Biden’s hands may well be tied if the Senate retains a Republican majority as anticipated. Consequently, it is unlikely that Biden will change Trump’s tariffs soon after his inauguration.

“In the longer term, a less-combative approach to trade negotiations should support grains exports, the leading dry bulk market for the US.”

Chinese demand quandary

As for the strength of bulk carrier demand more generally in 2021, again the focus will be on China.

In late 2020, the big story in the bulk shipping market was China’s apparent block on imports of coal from Australia. Not only were new orders being canceled, but vessels already waiting to unload were facing extended delays in China. According to ship-tracking data from VesselsValue, as of mid-November there were 133 dry bulk vessels waiting to discharge in Chinese ports, 59 of which had been waiting for 20 days or more. Bimco said it was aware that some ships had been waiting since June.

The coal trade is therefore the joker in the pack for dry bulk in 2021. Even though a lot of coal shipped from Australia to China is moved on capesize vessels, there is always an impact on the smaller ships — especially panamax vessels — in terms of overall available capacity when vessels are essentially taken out of the system due to port holdups.

Next year, China could substitute Australian coal with purchases from alternative suppliers. The location of those suppliers and the subsequent ton-mile demand impact on the market could be a significant factor in overall vessel demand next year.

“In the short term, delays in discharging reduces the supply of ships, increasing demand for ships that aren’t tied up and providing a little support to the dry bulk market,” Bimco noted.

Grain shipping outlook

The grain trade will, of course, also be influential in bulk shipping markets in 2021. Rahul Sharan, lead research analyst at Drewry, told World Grain that grain volumes had “been a good support” for dry bulk shipping in 2020 and “we are expecting growth in the grain trade to continue for the next five years.”

“In the previous five years the grain trade has expanded 2.3% each year and we expect that to continue,” Sharan said. “It’s a necessity commodity and trade still happens even if there has been a wider negative economic impact (such as COVID-19 in 2020).”

In terms of overall demand for dry bulk carriage, Sharan expects the dry bulk market to recover in 2021 with shipping volumes expanding 4.8% next year after contracting 2.4% in 2021. He predicts the bulk carrier fleet will only expand by 2.3% next year, a level that would mark the lowest increase in capacity since the turn of the century.

The upshot, according to most analysts, is likely to be higher shipping costs for grain traders in 2021.

Michael King is a multi-award-winning journalist as well as a shipping and logistics consultant. He also supplies an array of corporate services - www.mkingassociates.com. For more information, email mikeking121@gmail.com.