CHAMPAIGN, ILLINOIS, US — US grain farm incomes have trended above average the last three years but are expected to decrease in 2023 due to higher costs and projected lower grain prices, according to a report from the University of Illinois.

The coming year is filled with uncertainty, but farmers have built equipment and financial reserves to withstand low incomes, according to the report, “Grain Farm Income Projections for 2022 and 2023,” by Gary Schnitkey, Nick Paulson, Jim Baltz and Carl Zulauf.

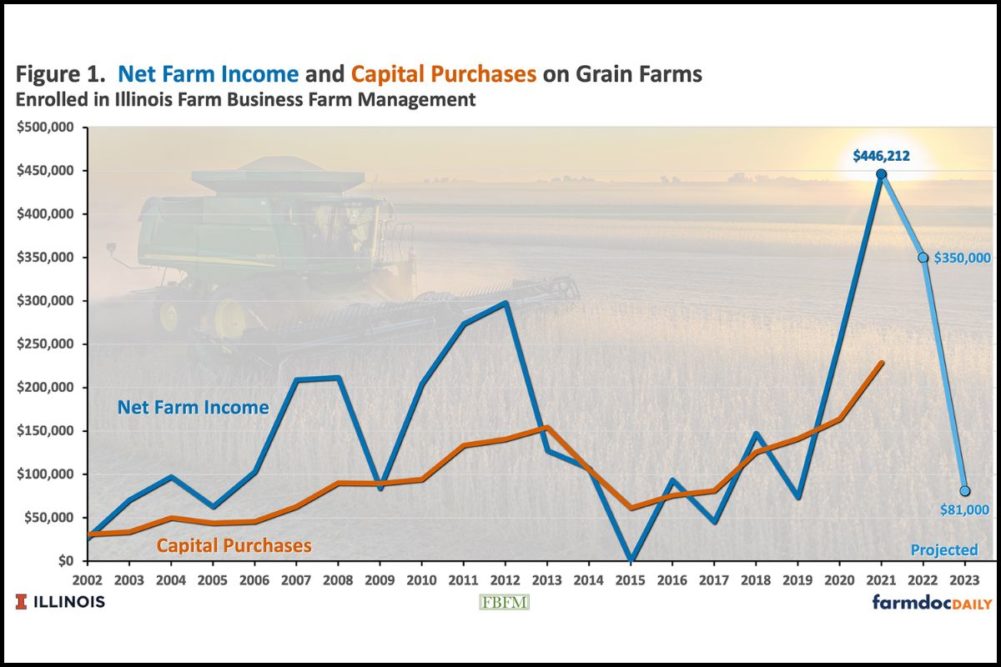

Net farm incomes were at high levels in 2020 and 2021. In 2020, the average farm income was $225,000 per farm, the third highest average income. Net farm income in 2021 was $446,000, a record level. Higher 2020 and 2021 incomes stood in contrast to average incomes from 2014 to 2019, when net incomes averaged $78,000 per farm.

Grain farm income in 2021 was high primarily because of above-trend yields and historically high grain prices.

The projected 2022 average income is $350,000 per farm, $96,000 lower than the 2021 level, the report said.

Higher commodity prices were more than offset by cost increases. From 2021 to 2022, non-land costs have increased by over $120 per acre for corn and $100 per acre for soybeans.

For 2023, incomes are projected at $81,000 per farm, a projection close to the 2014-2019 average of $78,000 per farm. Yields in 2023 are trend estimates. Costs are projected to continue to increase.

“…it is reasonable to expect grain farm incomes to return to a lower level in the future, as always happens in agriculture,” the report said. “Higher costs will lead to lower incomes even at historically high corn and soybean prices.

“Still, farmers are in excellent financial positions and will continue to build their financial positions in 2022. Farmers are preparing for lower incomes that inevitably occur in agriculture.”

Farmers have generally made capital investments on their farms during this period of higher incomes. Farmers typically make larger capital purchases during years of higher income and then reduce purchases during years of lower income.

Farmers have also built their working capital, as indicated by the current ratio. The current ratio equals current assets divided by current liabilities, with higher values indicating more current assets relative to current liabilities. In 2021, the current ratio was 3.32, the highest level since 2000 (see Figure 2). The 2021 ratio exceeded the previous high of 2.83, set after the high-income year in 2012.